Principal Mutual Fund has launched a large cap fund NFO. As per SEBI’s mandate large cap funds need to invest at least 80% of their assets in the Top 100 companies by market capitalization. The fund would remain open for subscription from 28th September 2020 to 12th October 2020.

This is an open-ended equity fund holding composite portfolio in Indian and US equity market predominantly in large cap stocks.

Here are the NFO issue details.

The Investment Objective of the scheme is to generate capital appreciation by investing in Large Cap Stock. However, there can be no assurance that the investment objective of the Scheme will be achieved.

| Scheme Opens | 2020-09-28 |

| Scheme Closes | 2020-10-12 |

| Scheme would reopen | 2020-10-20 |

| Scheme Plans | 1) Direct and Regular |

| 2) Growth and Dividend | |

| Minimum investment (Lumpsump) | Rs 5,000 |

| Minimum investment (SIP) | Rs 500 / 12 months |

| NAV of the fund | Rs 10 during NFO period |

| Entry Load | 0 |

| Exit Load | 0 – Upto 25% of units |

| 1% – > 24% of units if redeemed within 1 year | |

| Risk Classification | Moderate High |

| Max Total expense Ratio (TER) | 0.0225 |

| Fund Managers | Mr. Sudhir Kedia (MBA, CA and CFA) |

| has over 13 years of experience in research and asset management business. |

|

| Mr.Anirvan Sarkar (BE, PGD from IIM Culcutta) (For Foreign Investments) | |

| has over 9 years of experience in sell side and buy side research. |

The scheme’s asset allocation attributes will be

| Instruments | Minimum | Maximum | Risk Profile |

| Equity and equity related instruments of Large Cap Companies* | 80% | 100% | High |

| Equity and equity related instruments of Other than Large cap Companies | 0% | 20% | High |

| Debt and Money Market Instruments including units of debt & liquid schemes | 0% | 20% | Low to Medium |

*within the universe of large-cap the scheme would invest 0% to 20% in foreign securities

* the scheme will also invest in derivative but with a limit up to 50% of its net asset of the scheme

About The scheme’s Investment and portfolio construction strategy

- The scheme will have a diversified portfolio of 50 – 60 companies

- 80 – 85% of the scheme assets will be invested in Indian large cap companies (top 100 companies by market cap)

- Up to 15% of the scheme assets will be invested in US large cap companies (minimum market cap of $50 billion) across 4 to 6 major industry sectors. A composite portfolio of 85% Indian and 15% US large cap stocks produces superior risk adjusted returns

- The scheme will invest across industry sectors and stock selection will be process driven bottoms up approach.

- The investment strategy will be oriented more towards growth stocks compared to value stocks

- Earnings growth and return ratios will be the preferred metrics for stock selection

- The fund managers will focus on business models and management quality

- The fund managers will actively manage risk to reduce portfolio volatility

Why one should consider Large cap funds in his portfolio?

- Large cap companies’ stocks not only dominate in terms of market capitalisation but are also the segment leader with major market shares in terms of sales and profits. They are also capable of driving GDP growth.

- Large cap stocks are comparatively less volatile than small and midcap stock and they generate relatively stable returns over long term.

- Large cap stocks are more resilient in decline market. In bear phase of market where major the stocks prices fall the large cap stocks have shown maximum resilient in the downside market

- Large cap stocks have lower liquidity risk in volatile market as large cap companies have much higher number of free-floating shares in the market.

- Large cap stocks are proven wealth creators by virtue of their position of market leadership.

Why invest in composite portfolio of US and India Large cap stock?

- Investing in US large cap stock would add to the portfolio diversification adding performance and lowering the overall volatility. S&P 500 (index of 500 large cap companies in the US) in INR terms has outperformed the Nifty over multiple years.

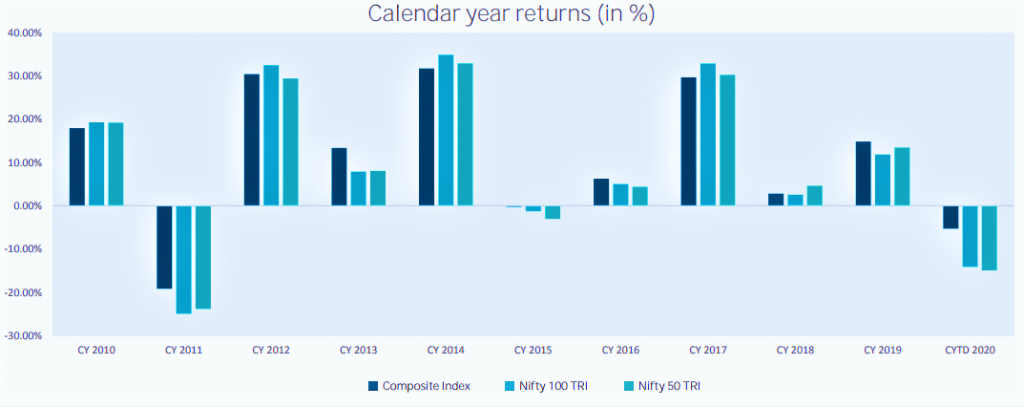

You can see below that S & P 500 INR index outperformed the nifty 100TRI and Nifty 50 TRI index in 7 out of 10 calendar years and given better trailing returns.

Source: Principal MF as on 31st July 2020. Disclaimer: The above analysis is for illustration only. Equity as an asset class is subject to market risks.Past performance may or may not be sustained in the future.

- US large companies are global leaders and are globally recognized brands. They dominate their respective industries. Purely as an example, 5 largest market cap stocks in S&P 500 are Microsoft, Apple, Google, Amazon and Facebook are not only among the best-known brands in the world, most of us are consumers of these brands.

- The exchange rate situation of the INR is also a good reason to diversify into US stocks. Over the past several years INR has been declining against USD and may continue to decline in the near to medium term. Further rupee depreciation may benefit in terms of return from S& P 500 index.

- On a back test over past 10 years, composite index with 15% of US large cap stocks (S&P 500 INR index) and 85% of Indian Large cap stocks (Nifty 100 TRI Index) have generated better risk adjusted returns as compare to Indian large cap stock index,

You can see that S&P 500 index outperformed Nifty 100 TRI index more than 5 times over a period of past 10 calendar years.

Source: Principal MF as on 31st July 2020. Disclaimer: The above analysis is for illustration only. Equity as an asset class is subject to market risks. Past performance may or may not be sustained in the future.

- Portfolio mix of US and Indian Large cap stock reduces the volatility risk vis-a- vis Indian indexes due to geopolitical and currency diversification.

Why invest in principal Large Cap Fund NFO?

- The current economic environment in the back-drop of COVID-19 pandemic is likely to result in significant earnings risk for companies. Large cap companies by virtue of their market share leadership, competitive moats and financial strength are better positioned to withstand this crisis and emerge stronger.

- Indian market cap to GDP ratio has been declined from 79% in FY 2019 to 54%in FY 20E GDP. This is much below its long-term average market cap ratio of 75%. This provides very strong opportunity for investments through new fund offer price. The current market cap ratio is close to the level last seen during the Global financial crisis in FY 2008.

- Principal Mutual Fund has a strong long-term performance track record. The fund house can benefit from Principal’s global investment experience, including access to advice and research from the US based PGI team. The fund managers of this scheme, Sudhir Kedia and Anirvan Sarkar have combined investment experience of more than 20 years.

Below are the performance of existing Large Cap funds as on 30/09/2020

| Returns (%) | |||||||

|---|---|---|---|---|---|---|---|

| Sr | Scheme Name | 1M | 6M | 1Y | 3Y | 5Y | Inception |

| 1 | Nippon India Large Cap Fund (G) | -5.11 | 2884 | -9.59 | 0.03 | 5.44 | 8.71 |

| 2 | HDFC Top 100 Fund (G) | -3.78 | 28.72 | -9.13 | 0.31 | 5.81 | 17.87 |

| 3 | Aditya Birla SL Frontline Equity Fund (G) | -1.07 | 35.83 | -0.49 | 1.34 | 6.49 | 18.53 |

| 4 | Tata Large Cap Fund (G) | -1.78 | 30.63 | -5.55 | 1.39 | 5.19 | 18.54 |

| 5 | DSP Top 100 Equity Fund-Reg (G) | 0.76 | 34.75 | -3.97 | 1.43 | 5.72 | 18.62 |

| 6 | ICICI Pru Bluechip Fund (G) | -1.9 | 35.3 | -1.36 | 3.33 | 7.97 | 12.16 |

| 7 | Mirae Asset Large Cap Fund-Reg (G) | -0.35 | 38.58 | 3.44 | 5.54 | 10.13 | 14.1 |

| 8 | Edelweiss Large Cap Fund(G) | -0.22 | 34.9 | 2.19 | 5.88 | 7.7 | 12.04 |

| 9 | Canara Rob Bluechip Equity Fund-Reg (G) | -0.11 | 32.71 | 8.41 | 8.76 | 9.99 | 10.54 |

| 10 | Axis Bluechip Fund-Reg (G) | 0.13 | 24.16 | 0.68 | 9.47 | 10.6 | 11.15 |

How the other schemes of the Principal Mutual Fund House performed

| Sr | Scheme Name | AUM | Returns (%) | |||

|---|---|---|---|---|---|---|

| INR (Crs) | 1Y | 3Y | 5Y | Inception | ||

| 1 | Principal Focused Multicap Fund(G) | 322.41 | 6.59 | 5.8 | 8.47 | 13.72 |

| 2 | Principal Equity Savings Fund(G) | 36.19 | 7.03 | 4.73 | 6.06 | 7.63 |

| 3 | Principal Dividend Yield Fund(G) | 151.48 | 6.72 | 4.34 | 9.89 | 11.23 |

| 4 | Principal Emerging Bluechip Fund(G) | 1782.5 | 8.59 | 2.6 | 10.24 | 22.28 |

| 5 | Principal Multi Cap Growth Fund(G) | 565.08 | 2.69 | 1.04 | 8.43 | 14.06 |

| 6 | Principal Tax Savings Fund | 338.72 | 3.17 | 0.84 | 8.25 | 14.94 |

| 7 | Principal Personal Tax Saver Fund | 202.89 | 2.78 | 0.18 | 4.71 | 17.81 |

| 8 | Principal Small Cap Fund-Reg(G) | 151 | 24.27 | 0 | 0 | 13.55 |

| 9 | Principal Midcap Fund-Reg(G) | 217 | 0 | 0 | 0 | 3.3 |

Who Should invest in this scheme?

- Investors who want to get capital appreciation over long investment horizon.

- Investors who have moderately high-risk appetites and do not want to take very high risks

- Investors who want to have exposure predominantly in large cap stocks

- Investors who also want to get exposure to US stocks in their portfolios

- Investors who have long investment horizons. In our view, you should have minimum 5 years investment horizon for this fund

- New investors can invest in this NFO since volatility of this scheme will potentially be lower than schemes which have significant allocations to midcap and small caps

SMART and My GAIN Facility under NFO period

Principal Large cap Fund NFO has introduced a unique SMART facility to investor where amount invested in NFO shall get deployed into in 4 tranches (25%each) over 4months with diminishing balance remained invested in Principal Cash management Fund (Liquid Fund)

There is also My GAIN facility is available to investor whereby you can switch automatically from this scheme to any other scheme if the target rate of return is achieved.

Existing Investor can invest can invest by Login into our web-portal directly.

New Investor can invest by activating your one-time investment account by completing your KYC in just 10 minutes!

Simply send us a scanned copy of the following to contact@identityinvestments.in

- ID proof – PAN Card Copy

- Address proof

- Proof of Bank account

- Passport size colour photo

OR Write to us at admin@identityinvestments.in or call us at M:9920657907 for more information on scheme information documents and Key Memorandum Information documents for investing in NFO.