Services

Our Products and offerings

Financial Planning & Advisory

Our Financial planning and Advisory services work with individuals, families, and businesses to help these customers understand their financial circumstances and how to reach their short-term and long-term financial objectives.

We gather information about income, debt obligations, monthly expenses not related to debt, current investment holdings, savings account balances, tax liabilities, and insurance plans as part our advisory and planning consultations.

This helps analyze and present realistic, meaningful recommendations based on their customers’ financial situations and goals.

Portfolio Management

We help create and manage investment allocations for our esteemed customers. As Portfolio Manager we follow our research-based recommendations and as guiding principle to help meet customers their desired investment objectives.

We craft the investment packages after assessing appropriate level of risk based on the customer’s time horizon, risk preferences, return expectations and market conditions combined with their personal objectives through various investment instruments in proportion to their future fund needs.

We manage investors’ account to maintain a specific investment strategy or objective over time.

Tax Solutions

There is more to tax planning than exemptions available on savings. With our advice, you will pay the right amount of tax, not more and not less. You will also know how to tax proof your incomes and gains. After all, your capital is more productive in your hands and it can work wonders for you if planned properly.

We guide you in the Planning & managing your finances and achieving your financial goals. Basic planning starts with Tax planning as good tax planning can increase the take home salary. These investments can also cater to a few of your needs if this is well planned. Tax planning is not restricted only to tax savings investments (Section 80C). There are several other components E.g HRA, Home Loans, LTA, Re-imbursements, etc to reduce the taxable income.

Mutual Funds

Diversification of funds – This diversification considerably reduces the risk of a serious monetary loss due to problems in a particular company or industry

Affordability – Small amounts periodically grows to a large corpus over a period of time

Flexibility – Enables you to change your portfolio balance as and when your personal needs, financial goals or market conditions change

Liquidity – Units or shares in a mutual fund can be bought and sold any business day

Professional Management – Mutual funds are managed by professionals who are experienced in investing money and who have the education, skills and resources to research diverse investment opportunities

Economics of Scale in transaction cost – Reduced cost compare to direct Equity exposure

Disciplined Investing – Systematic investment plans (SIPs) in mutual funds help investors to maintain a disciplined approach to savings and investment

Different products – includes Equity, conservative and Debt funds

Insurance is a contract that transfers the risk of financial loss from an individual or business to an insurance company. The company collects small amounts of money from its clients and pools that money together to pay for losses

Insurance is divided into two major categories:

Property and Casualty insurance

Life and Health insurance.

Property and casualty insurance provide protection to businesses and individuals for losses related to their belongings or assets, both physical and financial. Life and health insurance protect people from financial loss due to premature death, sickness or disease.

FDs one of the oldest and most common methods of investing. Gives assured returns with the right type of savings scheme makes all the difference. It is a form of wealth creation at low risk

FD Offerings

- Financial Institutions

- Non-Banking Finance Companies (NBFCs)

- Housing Finance Companies

- Nationalized and Private Banks

Features:

- Corporate / Company Fixed Deposits offer comparatively higher returns than banks

- Tenure varies from few months to a year and up to 5 years

- Interests are paid monthly, quarterly, yearly or on maturity

- Diversify risks by opting various options

- Interest rates vary based on Government regulations

- Minor penalty on premature withdrawals

Someone is sitting in the shade today because someone planted a tree long time ago

An Investment in the knowledge pays the best interest

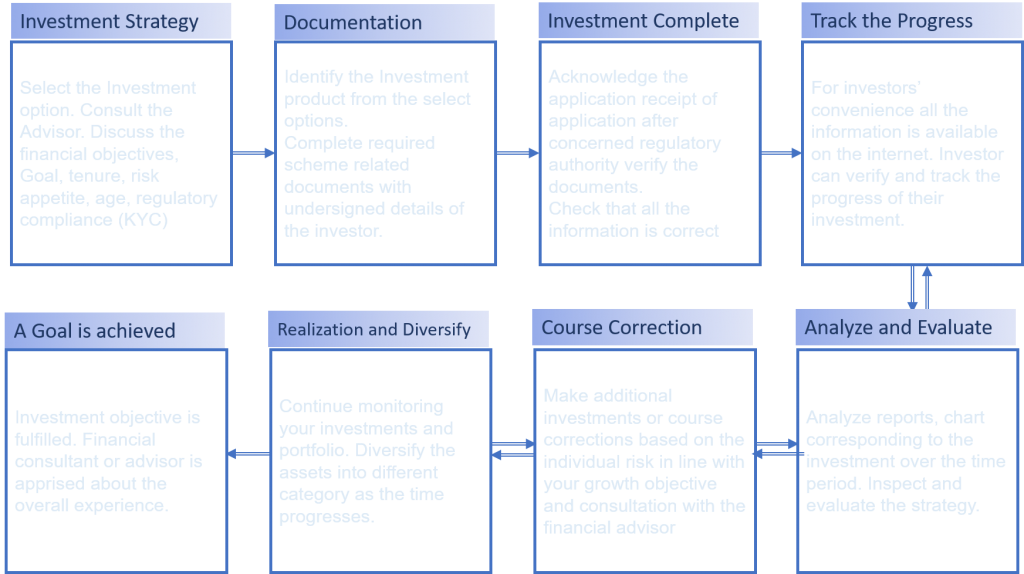

How does it happen in a flow?