What is Wealth? What purpose does it serve?

Many answer these questions as “living a life of one’s dreams”, or “not having to worry about money”, or “having financial freedom”. Being wealthy means having enough money to spend for one’s responsibilities and dreams.

At times Everyone has their future responsibilities and obligation for their loved ones and family like children educations, their wedding, fund for retirement life, aspiration to become rich or wealthy, etc. Individual’s salary or average income source would not save enough for such big-ticket size expenses and therefore a goal-based discipline approach with regular savings in mutual funds can help individuals to fulfil such big-ticket expense in future.

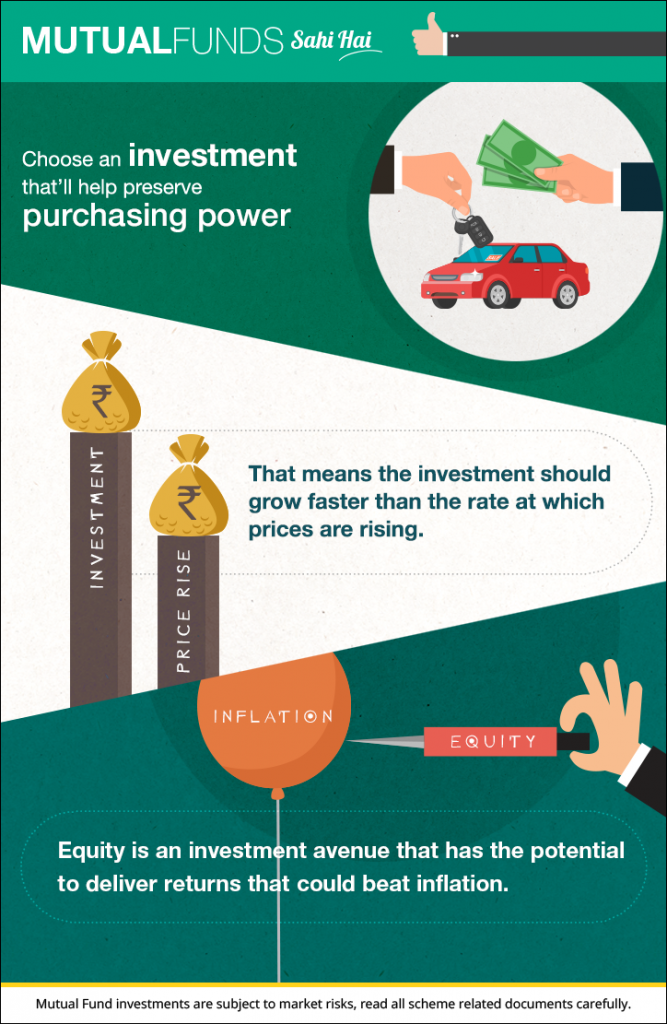

However, for all the long-term expenses one must not forget the inflation factor. Hence one’s present investments must be such that it gives future benefits over and above the inflation cost.

Business and commerce are the common ways to create wealth by investing our money with those who are engaged in such activities and earn profits to create a wealth over a period of time. We, as an investor invest our money with these businesses, entrepreneurs, by buying in stocks of these companies. As the entrepreneurs and the managers run their businesses efficiently and profitably, shareholder get benefited.

But how we come to know that which stocks are good to buy and when to buy which can optimise our benefits?

In this regard Mutual Fund is the great way to build wealth. Diversified equity funds offer the opportunity to create wealth over the long term at reasonable levels of risk.

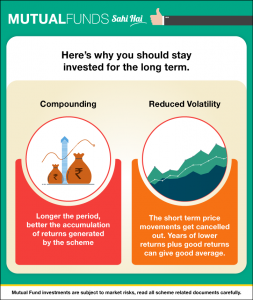

Mutual Funds schemes are managed with an objective to appreciate capital value invested and build wealth in long run. Investing for the long term which lowers the impact of short-term volatility. Thus, investor who stays invested for long period of time can easily create the wealth in future.

Mutual funds are managed by professionals with expertise in-depth study into company’s fundamentals and potentials with a view of deriving long term benefit from it.

Mutual funds also take advantage of large corpus to explore more opportunities simultaneously. As against the Single investor investing in multiple stocks, mutual fund invests collectively from multiple investors in multiple stocks of different companies.

Like a balanced diet – we all need proteins, vitamins, carbohydrates, etc. Eating only one type results in s

ome nutrient deficiency. Similarly, in a diversified equity fund you’re exposed to different segments of the economy, and also protected from the potential downside.

Mutual funds not only diversify risk exposure but also optimise our returns by adopting different kind of investment strategy like value-based investing, arbitraging investing, sectoral investing, rule-based investing, wide assets-based investing, fixed income-based investing etc. This adds value in growth of investors’ funds.

There are wide categories of Mutual funds schemes available based on investing method

of each particular scheme like large cap, mid cap, small cap, value fund, sector fund, arbitrage fund, hybrid funds etc. This offers choice to investor to select right funds for wealth creation in accordance with his/her risk bearing capacity.

Mutual funds are regulated under rules and regulation framed from time to time by Securities and Exchange Board of India (SEBI). Thus, investors’ interest in the mutual funds are well protected by the Government of India.

Systematic Investment plans offered by the mutual funds inculcates discipline and regular savings habit which mitigate the volatility risk of market. An Investor can start investing with as low as amount of Rs 100/- in mutual funds schemes.

Some of the mutual funds’ schemes have been set up and are managed with an objective to provide specific goal-based solutions to the investor for his/her future financial needs. Children education plan, retirement plan schemes, pensions plans scheme, Tax savings schemes are some of the long-term wealth creating plan which can help investor to achieve their financial needs without any worry.

To Conclude:

- Investments through Mutual Funds is a great way for long term wealth creation

- As Mutual funds are managed by professional fund manager, it controls the risk exposure by their expertise knowledge.

- Long term investments in equity mutual funds mitigates short term volatility risk and gives

- compounding returns in long run period.

- Mutual Fund optimise the returns with many risk averse investment strategy which adds value to the growth in investors’ fund.

- You can allocate your funds in combination of one or more categories of scheme in line with your optimum risk profiling.

- Investor can select from wide categories of mutual fund best suit to your risk appetite.

- You can invest specific goal based mutual fund scheme worry free in order to fulfil specific future financial goal

Get Started creating wealth for your future

Activate your account by completing your KYC in just 10 minutes! Simply send us a scanned copy of the following to contact@identityinvestments.in

- ID proof – PAN Card Copy

- Address proof

- Proof of Bank account

- Passport size colour photo

Click Here to activate your investments account.